Increase Your Credit Score FAST By Removing Negative Items

"Clean up errors on your report quickly"

RAPID Credit Repair For Those Who Can't Afford to Wait

90-Day Money Back Guarantee

Remove Judgements, Tax Liens, Bankruptcies & More

Qualify for Loans, Lower Interest Rates & Better Jobs

Get a FREE Credit Consultation!

Get a Free Credit Consultation!

Credit Analysis & Recommendations

Credit Analysis & Recommendations

Rapid Results Credit Repair

"Beware of Credit Repair Companies That Charge Monthly Fees!""

Most credit repair services charge a monthly flat-fee. While this may appear to be a good thing, it's actually counterintuitive & slows the entire process.

Think about it, if you charge clients on a monthly basis, you have ZERO incentive to resolve their issues quickly.

In fact you have every reason to stall the process & keep your paying customers around longer.

That's why we charge based on performance, NOT timetables. You only pay us when we've successfully deleted an item from your credit report aka "pay-per-deletion". That's why our clients see results 400% faster!

We Increase Your Credit Score!

"We Increase Your Score by Removing Inaccuracies"

Foreclosure

Bankruptcy

Judgements

Late Payments

Public Records

Collections

We Guarantee Results Or You Don't Pay a Dime!

Get a FREE Credit Consultation!

Get a Free Credit Consultation!

Includes in-depth credit analysis

Credit Analysis & Recommendations

How it Works!

3-Easy Steps to Get Started!

1

1Step 1:

Credit Health Analysis

2

2Step 2:

Dispute Process

3

3Step 3:

Build Positive Credit History Ready

See What Our Clients Are Saying

How Much & How Long?

Everyone's situation is unique so there's no one size fits all. However most our clients see results in as little as 30 days, with significant results in only 90 days. We produce the fastest results in credit repair no matter what your situation!

Get The Loan, Lower Interest Rate Or Better Job You Deserve!

Fix your credit score fast and secure your financial future!

Our Clients Typically See Results 400% Faster!

Pay AFTER Getting Results NOT before!

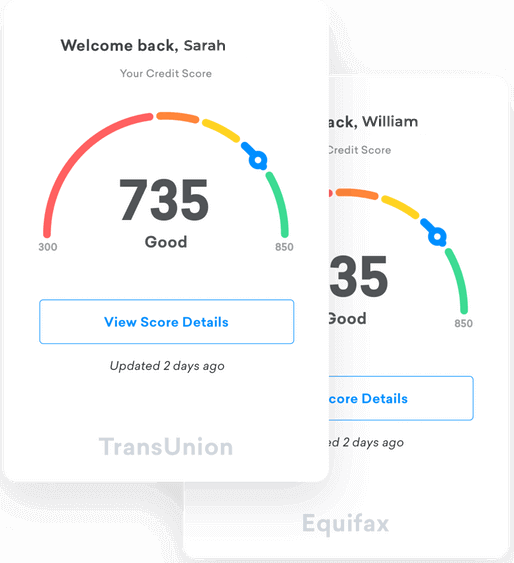

Customer Portal with Real Time Status Updates

In Business for 6+ Years with Impeccable Track Record

Our average client receives 80-150 point increase in 90 days!

About Springhill Credit

Springhill Credit Solutions was founded by Brian Fleming in 2013 leveraging his finance, law, credit and real estate experience to help others get the credit, financing and treatment they deserve.

Brian invested years of time and money to study under the top credit law and finance mentors in the nation, developing a bullet proof system that gets results at break neck speeds.

What began as personal necessity, transformed into a passion to help others, after realizing how unfair credit and financial institutions can be at times. Brian leads a team of credit law and debt negotiation experts who never cookie cuts but instead creatively innovates new techniques to stay a step ahead.

We’ll help you get approved to buy products and services you were previously denied credit to obtain. And by qualifying you for lower interest rates, you’ll save money on every big ticket item you’ll ever need, whether it’s a car, a home, investment property, a loan to start a business, or whatever else you’re dreaming of. Just imagine what it will be like to find yourself months from now—breathing easier & feeling better than you have in years. Feel better already? We thought so. We can make it happen.

We Guarantee Results Or You Don't Pay a Dime!

Get a FREE Credit Consultation!

Get a Free Credit Consultation!

Includes in-depth credit analysis

Credit Analysis & Recommendations

Ironclad Money-Back Guarantee

You don't pay a dime until we get results!

Pay For Performance Credit Repair

Privacy Policy

At Springhill Credit Solutions , the privacy of our visitors is of extreme importance to us. This privacy policy document outlines the types of personal information is received and collected by Springhill Credit Solutions and how it is used.

Privacy Statement

We are committed to protecting your privacy. Authorized employees within the company on a need to know basis only use any information collected from individual customers. We constantly review our systems and data to ensure the best possible service to our customers. Parliament has created specific offences for unauthorised actions against computer systems and data. We will investigate any such actions with a view to prosecuting and/or taking civil proceedings to recover damages against those responsible

Confidentiality

We are registered under the Data Protection Act 1998 and as such, any information concerning the Client and their respective Client Records may be passed to third parties. However, Client records are regarded as confidential and therefore will not be divulged to any third party, other than law enforcement entities if legally required to do so to the appropriate authorities. Clients have the right to request sight of, and copies of any and all Client Records we keep, on the proviso that we are given reasonable notice of such a request. Clients are requested to retain copies of any literature issued in relation to the provision of our services. Where appropriate, we shall issue Clients with appropriate written information, handouts or copies of records as part of an agreed contract, for the benefit of both parties.

We will not sell, share, or rent your personal information to any third party or use your e-mail address for unsolicited mail. Any emails sent by this Company will only be in connection with the provision of agreed services and products.

Log Files

Like many other Web sites, Springhill Credit Solutions makes use of log files. The information inside the log files includes internet protocol ( IP ) addresses, type of browser, Internet Service Provider ( ISP ), date/time stamp, referring/exit pages, and number of clicks to analyze trends, administer the site, track users movement around the site, and gather demographic information. IP addresses, and other such information are not linked to any information that is personally identifiable.

Cookies and Web Beacons

Springhill Credit Solutions does use cookies to store information about visitors preferences, record user-specific information on which pages the user access or visit, customize Web page content based on visitors browser type or other information that the visitor sends via their browser. If you wish to disable cookies, you may do so through your individual browser options. More detailed information about cookie management with specific web browsers can be found at the browsers’ respective websites. The content of your modal.

Terms and Conditions

In using this website you are deemed to have read and agreed to the following terms and conditions:

1. Collection of Information.

1.1 Survey Information.

Springhill Credit Solutions collects information from individuals by various methods, including, but not limited to, when an individual voluntarily completes a Springhill Credit Solutions survey, order form, or a registration page either online or offline, or by means of online or offline surveys, order forms, or registration pages operated by third parties (collectively, a “Survey”). (As used herein, “online” means using the Internet, including the Websites, and related technologies, and “offline” means by methods other than online, including in person, in the postal mail, using telephones and cell phones, and other similar means.) In the Surveys, Springhill Credit Solutions may ask an individual to provide various information to Springhill Credit Solutions , which may include his or her name, email address, street address, zip code, telephone numbers (including cell phone numbers and carriers), birth date, gender, salary range, education and marital status, occupation, social security number, employment information, personal and online interests, and such other information as may be requested from time to time (together, “Survey Information”). Springhill Credit Solutions may also collect information concerning an individual from another source and uses that information in combination with information provided from this web site. Completing the Surveys is completely voluntary, and individuals are under no obligation to provide Survey Information to Springhill Credit Solutions , but an individual may receive incentives from Springhill Credit Solutions in exchange for providing Survey Information to Springhill Credit Solutions .

1.2 Third Party List Information.

Springhill Credit Solutions collects information from individuals when an individual provides information to a third party and Springhill Credit Solutions subsequently purchases, licenses, or otherwise acquires the information from the third party (the “Seller”). Such purchased information may include, but is not limited to, an individual’s name, email address, street address, zip code, telephone numbers (including cell phone numbers and carriers), birth date, gender, salary range, credit card information, education and marital status, occupation, industry of employment, personal and online interests, and such other information as the individual may have provided to the Seller (together, “Third Party List Information”). When acquiring Third Party List Information, Springhill Credit Solutions seeks assurances from the Seller that the Seller has a right to transfer the Third Party List Information to Springhill Credit Solutions and that the Seller has a right to provide offers from advertisers to the individuals whose personal information is included on the Seller’s list.

1.3 Other Information.

Other occasions when Springhill Credit Solutions obtains information from individuals include (1) when an individual is making a claim for a prize or seeking to redeem an incentive offered by Springhill Credit Solutions (2) when an individual requests assistance through Springhill Credit Solutions ‘s customer service department, and (3) when an individual voluntarily subscribes to a Springhill Credit Solutions service or newsletter (together, “Other Information”).

1.4 Cookies, Web Beacons, and Other Info Collected Using Technology.

Springhill Credit Solutions currently uses cookie and web beacon technology to associate certain Internet-related information about an individual with information about the individual in our database. Additionally, Springhill Credit Solutions may use other new and evolving sources of information in the future (together, “Technology Information”).

(a) Cookies.

A cookie is a small amount of data stored on the hard drive of the individual’s computer that allows Springhill Credit Solutions identifies the individual with his or her corresponding data that resides in Springhill Credit Solutions ‘s database. You may read more about cookies at http://cookiecentral.com. Individuals who use the Websites need to accept cookies in order to use all of the features and functionality of the Websites.

(b) Web Beacons.

A web beacon is programming code that can be used to display an image on a web page but can also be used to transfer an individual’s unique user identification (often in the form of a cookie) to a database and associate the individual with previously acquired information about an individual in a database. This allows Springhill Credit Solutions to track certain web sites an individual visits online. Web beacons are used to determine products or services an individual may be interested in, and to track online behavioral habits for marketing purposes. For example, Springhill Credit Solutions might place, with the consent of a third party website, a web beacon on the third party’s website where fishing products are sold. When Bill, an individual listed in Springhill Credit Solutions ‘s database, visits the fishing website, Springhill Credit Solutions receives notice by means of the web beacon that Bill visited the fishing site, and Springhill Credit Solutions would then update Bill’s profile with the information that Bill is interested in fishing. Springhill Credit Solutions may thereafter present offers of fishing related products and services to Bill. In addition to using web beacons on web pages, Springhill Credit Solutions also uses web beacons in email messages sent to individuals listed in Springhill Credit Solutions ‘s database.

(c) New Technology.

The use of technology on the Internet, including cookies and web beacons, is rapidly evolving, as is Springhill Credit Solutions ‘s use of new and evolving technology. As a result, Springhill Credit Solutions strongly encourages individuals to revisit this policy for any updates regarding its use of technology.

1.5 Outside Information.

Springhill Credit Solutions may receive information about individuals from third parties or from other sources of information outside of Springhill Credit Solutions including information located in public databases (“Outside Information”).

1.6 Individual Information.

As used herein, Individual Information means Survey Information, Third Party List Information, Other Information, Technology Information, and Outside Information, and any other information Springhill Credit Solutions gathers or receives about individuals.

1.7 No Information Collected from Children.

Springhill Credit Solutions will never knowingly collect any personal information about children under the age of 13. If Springhill Credit Solutions obtains actual knowledge that it has collected personal information about a child under the age of 13, that information will be immediately deleted from our database. Because it does not collect such information, Springhill Credit Solutions has no such information to use or to disclose to third parties. Springhill Credit Solutions has designed this policy in order to comply with the Children’s Online Privacy Protection Act (“COPPA”).

1.8 Credit Card Information.

Springhill Credit Solutions may in certain cases collect credit card numbers and related information, such as the expiration date of the card (“Credit Card Information”) when an individual places an order from Springhill Credit Solutions . When the Credit Card Information is submitted to Springhill Credit Solutions , such information is encrypted and is protected with SSL encryption software. Springhill Credit Solutions will use the Credit Card Information for purposes of processing and completing the purchase transaction, and the Credit Card Information will be disclosed to third parties only as necessary to complete the purchase transaction.

2. Use of Individual Information.

2.1 Discretion to Use Information.

THE COMPANY MAY USE INDIVIDUAL INFORMATION FOR ANY LEGALLY PERMISSIBLE PURPOSE IN COMPANY’S SOLE DISCRETION. The following paragraphs in Section 2 describe how Springhill Credit Solutions currently uses Individual Information, but Springhill Credit Solutions may change or broaden its use at any time. As noted below, Springhill Credit Solutions may update this policy from time to time. Springhill Credit Solutions may use Individual Information to provide promotional offers to individuals by means of email advertising, telephone marketing, direct mail marketing, online banner advertising, and package stuffers, among other possible uses. If you do not wish us to use personal information about you to promote or sell our products and services or to sell, transfer or otherwise provide personal information about you to third parties, please inform us by contacting customer service at 888-222-4470and we will certainly honor your request.

2.2 Email.

Springhill Credit Solutions uses Individual Information to provide promotional offers by email to individuals. Springhill Credit Solutions may maintain separate email lists for different purposes. If email recipients wish to end their email subscription from a particular list, they need to follow the instructions at the end of each email message to unsubscribe from the particular list.

2.2(a) Content of Email Messages.

In certain commercial email messages sent by Springhill Credit Solutions , an advertiser’s name will appear in the “From:” line but hitting the “Reply” button will cause a reply email to be sent to Springhill Credit Solutions . The “Subject:” line of Springhill Credit Solutions email messages will usually contain a line provided from the advertiser to Springhill Credit Solutions .

2.2(b) Solicited Email.

Springhill Credit Solutions only sends email to individuals who have agreed on the Websites to receive email from Springhill Credit Solutions or to individuals who have agreed on third party websites to receive email from third parties such as Springhill Credit Solutions . Springhill Credit Solutions does not send unsolicited email messages. As a result, statutes requiring certain formatting for unsolicited email are not applicable to Springhill Credit Solutions ‘s email messages.

2.3 Targeted Advertising.

Springhill Credit Solutions uses Individual Information to target advertising to an individual. When an individual is using the Internet, Springhill Credit Solutions uses Technology Information (see also Section 2.5 below) to associate an individual with that person’s Individual Information, and Springhill Credit Solutions attempts to show advertising for products and services in which the person has expressed an interest in the Surveys, indicated an interest by means of Technology Information, and otherwise. Springhill Credit Solutions may, at its discretion, target advertising by using email, direct mail, telephones, cell phones, and other means of communication to provide promotional offers.

2.4 Direct Mail and Telemarketing.

Springhill Credit Solutions uses Individual Information to advertise, directly or indirectly, to individuals using direct mail marketing or telemarketing using telephones and cell phones.

2.5 Use of Technology Information.

Springhill Credit Solutions uses Technology Information (1) to match a person’s Survey Information and Third Party List Information to other categories of Individual Information to make and improve profiles of individuals, (2) to track a person’s online browsing habits on the Internet, (3) to determine which areas of Springhill Credit Solutions ‘s web sites are most frequently visited. This information helps Springhill Credit Solutions to better understand the online habits of individuals so that Springhill Credit Solutions can target advertising and promotions to them.

2.6 Profiles of Individuals.

Springhill Credit Solutions uses Individual Information to make a profile of an individual. A profile can be created by combining Survey Information and Third Party List Information with other sources of Individual Information such as information obtained from public databases.

2.7 Storage of Individual Information.

Springhill Credit Solutions stores the Individual Information in a database on Springhill Credit Solutions computers. Our computers have security measures (such as a firewall) in place to protect against the loss, misuse, and alteration of the information under Springhill Credit Solutions ‘s control. Not with standing such measures, Springhill Credit Solutions cannot guarantee that its security measures will prevent Springhill Credit Solutions computers from being illegally accessed, and the Individual Information on them stolen or altered.

3. Dissemination of Individual Information.

3.1 Sale or Transfer to Third Parties.

Springhill Credit Solutions WILL NOT SELL OR TRANSFER INDIVIDUAL INFORMATION TO THIRD PARTIES FOR ANY PURPOSE WHATSOEVER UNLESS AS STIPULATED HEREIN.

3.2. Unsubscribe Procedures.

If you wish to discontinue receiving email messages from Springhill Credit Solutions please email us at info@SpringhillCredit.com